What is the Bitcoin Fear and Greed Index?

The “Crypto Fear and Greed Index” is a tool for measuring the market’s status, mirrored after CNN Money’s fear and greed index for the S&P 500, which helps determine investor’s appetite for the stock market stocks.

CNN Money’s ‘Fear and Greed Index’

When CNN Money began implementing the F&G index, it was to help determine whether a stock market holds a “fair” valuation during any given time. It also helps realize that great investor fear drives down prices, while implying that excessive greed increases prices.

This led to the Bitcoin Fear and Greed Index (“BTC Fear and Greed Index) which mirrors CNN Money’s F&G index.

Source: Investingcube.com

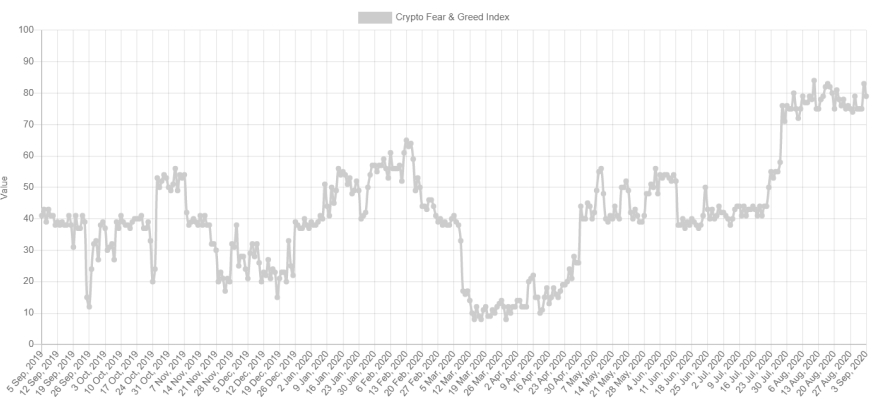

The most important thing to take away from this index, is that it’s Bitcoin-focused, showing its overall volatility over a 30 and 90-day period. Since Bitcoin is arguably the industry’s premiere digital currency, all cryptocurrencies are (for the most part) correlated to Bitcoin’s overall performance, giving rise to the creation and desire for such an index.

If you’re new to crypto, particularly Bitcoin, anytime BTC price surges, most altcoins (any coin other than Bitcoin) tend to also increase in value. The same can be said when the price of Bitcoin drops.

And why is that? Speculation and fear. Which is what powers this BTC F&G Index. At its most basic level, this index measures how “overbought” or “oversold” the cryptocurrency market is, which reflects investors emotions through listed asset’s prices.

If the market is “overbought” and potentially ready for a sell-off, the index will reflect a ‘Greedy’ status.

In contrast, if the market is “oversold” and potentially offers a buying opportunity, the index will reflect “Fearful”.

How the Index is Measured

The Index is measured by seven factors, such as volatility, market momentum/volume, social media impressions, and surveys, which are calculated on a percentage. It’s worth noting that the Index is never 100% accurate and not the most ideal tool to understand market sentiment in calculating entries and exits. Think of it more as a barometer for crowd market-time, showing only the present sentiment of the market.

Having said that, let’s explore each.

Volatility (25% Index Score)

Twenty-five percent of the index measures volatility, comparing Bitcoin’s average values of the last 30 days and 90 days. Usually, an unusual rise in volatility leads the industry to believe a fearful market is present.

Market Momentum/Volume (25% Index Score)

Under the Market Momentum indicator, consumers are able to see the total number of coins that are at high-buying volumes versus low-purchasing volumes, over a period of 30 and 90 days. Once buying volumes increase, greed enters the picture, causing the index’s greed levels to rise.

Social Media (15% Index Score)

The index collects and monitors data for each coin from various social media hashtags, for those specific coins. The purpose of which is to see how many interactions these coins receive over certain time-frames.

Bitcoin Dominance (10% Index Score)

The dominance of a coin resembles the market cap share of the whole crypto market. As Bitcoin’s dominance rises on the index, so does market greed, as individuals begin to invest in BTC. On the flip-side, when Bitcoin dominance decreases, people begin to get scared and fearful on whether they should invest into BTC.

Google Trends (10% Index Score)

This program pulls Google Trends data for various Bitcoin-related search queries, looking at changes in numbers with respect to search volumes. By simply typing in “Bitcoin”, you would expect to see a number of sorts, indicating a percentage increase (or decrease) in price manipulation--illustrating greed or fear in the market. That information is used in measuring the Index.

Survey Results (15% Index Score)

You won’t see much on this, as this factor is currently paused. So, this is something you can pass over.

At the end of the day, if you are comparing the traditional S&P 500 fear and greed index with the Bitcoin Fear and Greed Index, it’s a difference of market sentiment (and of course the market itself).