What is Bitcoin Halving?

When you hear the term bitcoin “halving”, you need to immediately think total bitcoin circulation. Remember, Bitcoin was created as a “deflationary asset”, which by having a set number supply, keeps consumer demand high and the value as high as possible.

Therefore, to keep Bitcoin as a deflationary asset, incentives should be in place that help stimulate the flow and demand for it. You may recall that new bitcoins enter circulation as block rewards, produced by miners who use their equipment to earn or mine them.

With a total number and maximum supply of 21 million bitcoins in supply, it also needs to be properly managed, so that all 21 million aren’t just released into the crypto-wild.

For this reason, Satoshi Nakamoto implemented this mechanism into the system to maintain bitcoin’s unique characteristic as a deflationary asset. This is why roughly every four years or every 210,000 blocks, the total number of bitcoin that miners can earn/mine is “halved”.

“Halving” Defined

So, what is bitcoin “halving?” Halving is an event (also called a ‘halvening’) where the reward for mining new blocks is “halved” or reduced by 50% fewer bitcoins for doing the same amount of work (verifying transactions) as a miner usually does.

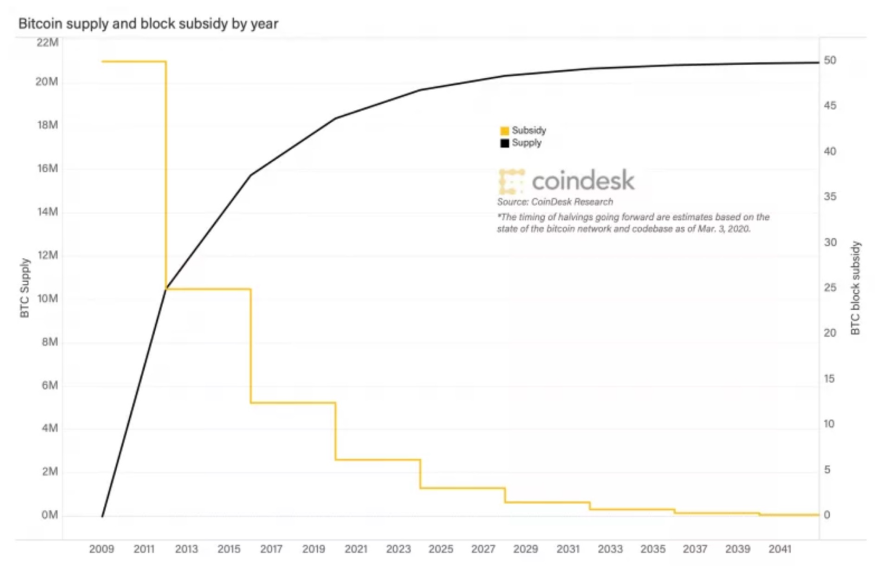

Source: CoinDesk

The purpose of restricting the number of new bitcoins that are generated by the network, again is to implement that “check” against the total maximum bitcoin supply, so it’s never truly depleted—otherwise, it’s no longer a unique asset and one anybody can find anywhere. This defeats the purpose behind its value.

Which brings us into why Nakamoto chose to program the block reward to decrease over time.

Why There’s Only 21 Million Bitcoin in Existence

Recalling that there are 21 million bitcoins in circulation, why does there need to be a cap? There’s so many, right? Yes and no.

In 2009, 50 bitcoins were mined per block every 10 minutes, adding to the supply. Two halvings later, 12.5 bitcoins were dispensed every 10 minutes. So, at that rate, it’s estimated that by 2041, this halving process will end, depleting the remaining supply of bitcoin in circulation.

Well, Nakamoto had three reasons behind the upper cap:

#1—Bitcoin Must Be a ‘Deflationary Asset’

The most important reason is to avoid exactly what the U.S. Federal Reserve does in controlling the US Dollar. As you know fiat currency is extremely inflationary, meaning that anytime the U.S. government wants to regulate the supply of cash, it has the necessary resources to either inject more and/or remove cash into the system--a practice many believe to be highly controversial and unethical.

Nakamoto specifically created the upper cap so that nobody, including the government can influence the supply at their own whim. By removing the human element and programming distribution into code, the system favors decentralization.

#2—Preventive Measure

The second reason speaks to Bitcoin’s initial infrastructure. Nobody, including Nakamoto knew whether or not Bitcoin would actually be adopted (or taken seriously). So, what do you do when you want to attract a large number of potential investors towards something that could be a huge profit gain?

You fix the supply at a certain number, hinting towards a possibly unique and rare investment. Thus, the incentive to actually invest in and acquire Bitcoin before it “disappeared” increased.

#3—Tokenomics

Lastly, if and when all the bitcoins have been mined, by applying tokenomics, transaction fees could help cover the costs after all the coins have been mined.

What makes halving so exciting to investors, is the hope that the price of bitcoin will increase, because of the reward being sliced in half over time. But the truth is, nobody can really predict what will happen with its price. For more information behind Bitcoin’s monetary policy, please read Satoshi Nakamoto’s 2009 whitepaper which summarizes the reasons.

As of 2020, Bitcoin has experienced three halvings, most recently on May 18, 2020, which brought current mining rewards to 6.25 BTC per block.

First Halvening

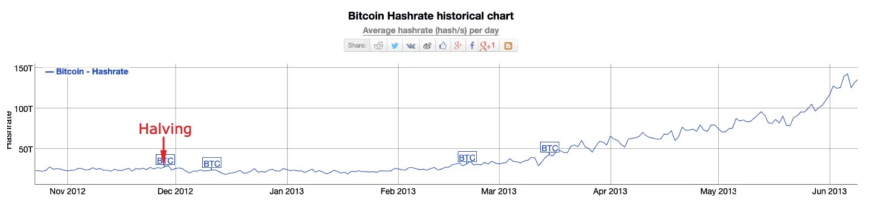

Source: Blockgeeks

The first halving occurred on November 28, 2012, bringing mining rewards to 25 BTC per block.

Take a look at the illustration above, which illustrates the effect of the first halving event. Within two weeks, you can see the hashrate of the network fell from 27.61 THash/s to 19.98 THash/s. Six months later, the hashrate then rose steadily to 60 THash/s.

As to whether Bitcoin’s price increased following the first halve, the price of BTC:USD rose from $11 to $12, before astronomically jumping to $1,038 in just one year—a 9,336.36% increase in price.

Second Halvening

On October 15, 2020, it was announced that the Associated Press (AP) and Everipedia will put the 2020 U.S. Presidential Election vote counts on the EOS blockchain, serving as a groundbreaking and landmark milestone for both the political and blockchain realms.

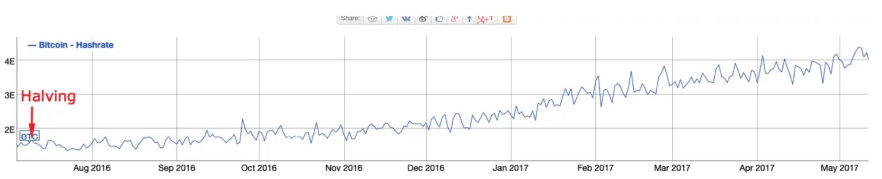

Source: Blockgeeks

The second halving took place on July 09, 2016, bringing mining rewards to 12.5 BTC per block. That same day, bitcoin’s price dropped by 10 percent to $610, but quickly increased back to where it was before—hence the unpredictability.

Looking at the hashrate from the above illustration depicting the effects of the second halving, the hashrate fell from 1.56 EHash/s to 1.40 EHash/s. Within seven months, the hashrate increased to 3.85 EHash/s.

As to whether Bitcoin’s price was impacted by the second halving, the price of BTC:USD increased from $576 to $650, most likely due to halving anticipation. One year later (July 9, 2017), Bitcoin’s value jumped 288.60%, ending that year’s valuation at $2,526.

Third Halving

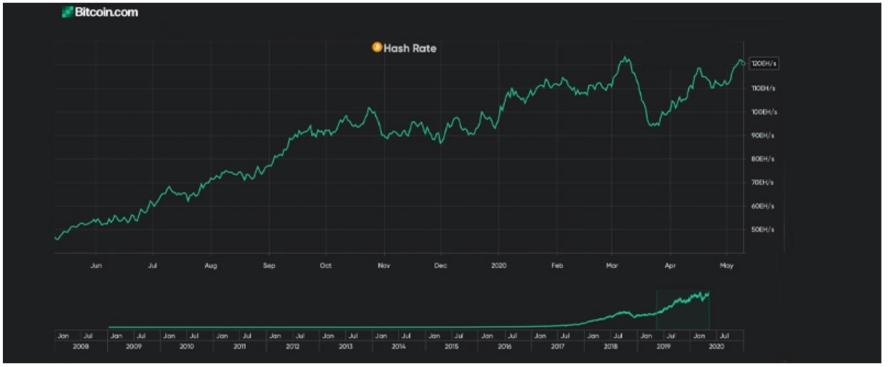

Source: Bitcoin.com

Bitcoin’s third halving is somewhat interesting. Initial reports on the anticipated halving expected it to occur on May 12, 2020. However, due to the speed of the network, it actually occurred on May 11, 2020.

At the time Bitcoin.com initially reported the halving, BTC’s hashrate was around 120EH/s and the price was in the mid-$8K range--somewhere between $8,300 and $8,700 per bitcoin all day.

The latest Bitcoin mining block reward halving reduced Bitcoin’s previous block reward from 12.5 BTC to 6.25 BTC.

CoinTelegraph reported that this Bitcoin halving will have a direct impact on miners, imminently triggering miners to shut down generating new Bitcoin as a wide number of mining devices will soon become outdated.

Fourth Halving

The fourth halving will take place some time in 2024, where BTC will be reduced to 3.125 BTC per block.

And all the way down to the final and 64th halving will take place in 2041. After the last Bitcoin gets mined, the miners will rely entirely on transaction fees as a means of revenue, rather than the block reward.

At this point, it would be safe to assume that because there will be no more new coins being mined (and injected into the system), the value of Bitcoin will increase, driving up the overall demand. Consequently, transaction fees will most likely spike as well.

To Recap

The goal, according to Satoshi Nakamoto for Bitcoin’s future after all coins have been mined, is that his internal tokenomics will kick in to sustain the entire network, replacing mining rewards. Industry experts still aren’t sure if it’s safe to assume that after every halving period, the value of Bitcoin will rise, but hey, welcome to the volatile market of cryptocurrency!