What is DeFi?

In our traditional world of finance, we have a centralized financial system, governed and regulated by financial institutions and third-party intermediaries.

Decentralized finance, or DeFi, however, removes those “middlemen” so to speak, and brings in digital assets, protocols, smart contracts, and DApps built on a blockchain. The term “DeFi” became a buzzword in 2019 following the valuations of MakerDao and Compound after both companies raised sizable rounds from the elite Silicon Valley-based Venture Capital firm Andreessen Horowitz.

Ethereum

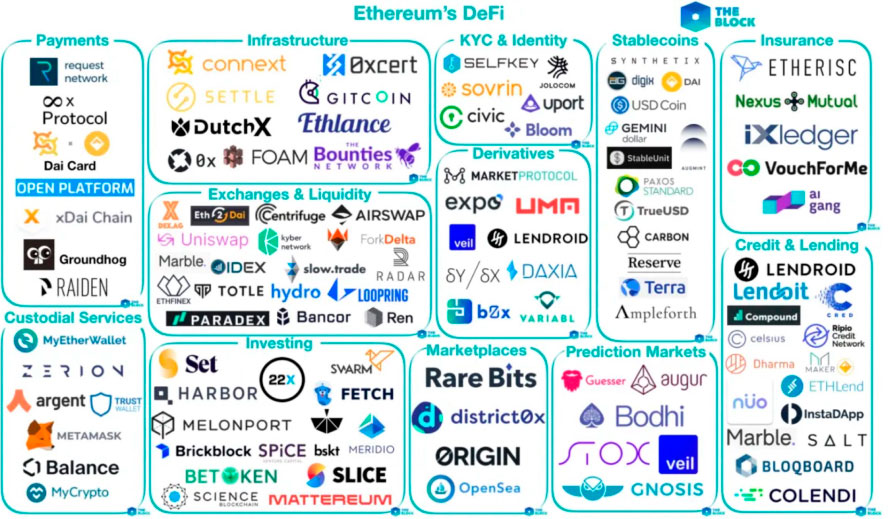

In short, DeFi is an open financial ecosystem where you can build various small financial tools and services in a decentralized manner. Since these applications are built on a particular blockchain, most favorably Ethereum, they can be combined, modified, and integrated accordingly. Most applications that call themselves “DeFi” are built on top of Ethereum, due to the platform’s ease in building DApps. Once Ethereum 2.0 is successfully implemented, this could provide a huge improvement to DeFi as well.

DeFi is unique in that it expands the use of traditional blockchain cases from simple value transfers to more complex financial use cases.

The DeFi System

The most popular types of DeFi applications include:

#1 - Decentralized Exchanges (DEXs)

Decentralized exchanges, or DEXs, help users exchange their currencies for other currencies--whether it’s U.S. Dollars (USD) for Bitcoin (BTC) or Ether (ETH) for DAI. These exchanges are very popular and help connect users directly so they can trade crypto with one another without entrusting their money to intermediaries.

#2 - Stablecoins

Stablecoins are valuable to traders because they provide stability and a shield against market volatility and fluctuations. These are cryptocurrencies tied to an asset outside of that crypto, such as the U.S. Dollar or Euro, to help stabilize the price.

There are three types of stablecoins--fiat-collateralized, crypto-collateralized, and non-collateralized. For more information, please click here.

#3 - Open Lending Platforms

Similar to a traditional financial institution or bank, users deposit their money and when someone else borrows the digital assets, they earn interest on Open Lending Protocols.

Lending markets are one popular form of DeFi, which connects borrowers to lenders of cryptocurrencies. One popular platform, Compound, allows users to borrow cryptocurrencies or offer their own loans. Users can make money off of interest for lending out their money. Compound sets the interest rates algorithmically, so if there’s higher demand to borrow a cryptocurrency, the interest rates will be pushed higher.

However, smart contracts, rather than third-party intermediaries, dictate the terms of the loan, implementing contractual conditions that must take place for an event to occur (or not occur).

Thanks to the transparent nature of the blockchain and no middlemen to slow things down, the lender is able to earn higher returns and more clearly understand the risks associated.

#4 - “Wrapped” Bitcoins (WBTC)

A Wrapped Bitcoin, or WBTC, is an ERC-20 token that represents Bitcoin, which launched on the Ethereum mainnet in January 2019. It is now controlled by the Decentralized Autonomous Organization (WBTC DAO)

1 WBTC = 1 BTC

This valuation allows for a BTC to be converted into WBTC, and vice-versa. As an ERC-20 token, transferring WBTC is much faster than normal Bitcoin. What makes WBTC unique is its integration into the world of Ethereum wallets, DApps, and smart contracts.

WBTC allows Bitcoin holders to continue HODLing, while also using DeFi apps, like Compound, MakerDAO, and Kava to borrow or lend money.

#5 - Prediction Markets

Prediction markets offer the ability to bet on the outcome of future events, such as elections.

What to Stay Updated On:

Yield Farming

Yield farming allows users to scan various DeFi tokens in search of opportunities for larger returns. Attracting quite a bit of attention throughout the DeFi space is Kava Labs’ Kava blockchain, which allows users to create collateralized debt positions, or CDPs, on the Kava protocol in exchange for a stablecoin. It is backed by several large exchanges, including Binance, Huobi, and OKEx, which stake kava tokens and participate in the blockchain’s governance.

Cybersecurity

In 2020, DeFi had some challenges, most notably the dForce ecosystem protocol Lendf.me losing 99.95% of its funds from a hacking exploit. Days following the hack, the hacker leaked information about his identity that resulted in him returning most of the stolen funds. This news came following DeFi’s greatest test on March 12, when the Ether (ETH) price sharply fell, causing systems to become overly stressed and fail.

The big loser that day was MakerDao, whose poor architecture and infrastructure was exposed due to the limitations of the Ethereum network.

Brian Kerr, the CEO of DeFi lending platform Kava Labs, spoke to Cointelegraph about what went wrong with dForce that allowed this hack to transpire. In mid-2019, Kava announced its stablecoin USDX. Shortly after, dForce released its own stablecoin ticker name as USDx. The use of Kava’s USDX ticker displays the limited creativity at dForce, which is likely extended to its code and technical talent as well. Robert Leshner, CEO of DeFi lending company Compound Finance, personally spoke with Cointelegraph in an interview, following his tweet about the $25 million hack and claiming that the company stole code that is recognizable as Compound’s.