What is Coin Market Capitalization?

Whenever you are conversing about cryptocurrency and digital monies, it’s important you are aware of its value, or market capitalization (Market Cap), which by definition originated from the stock market.

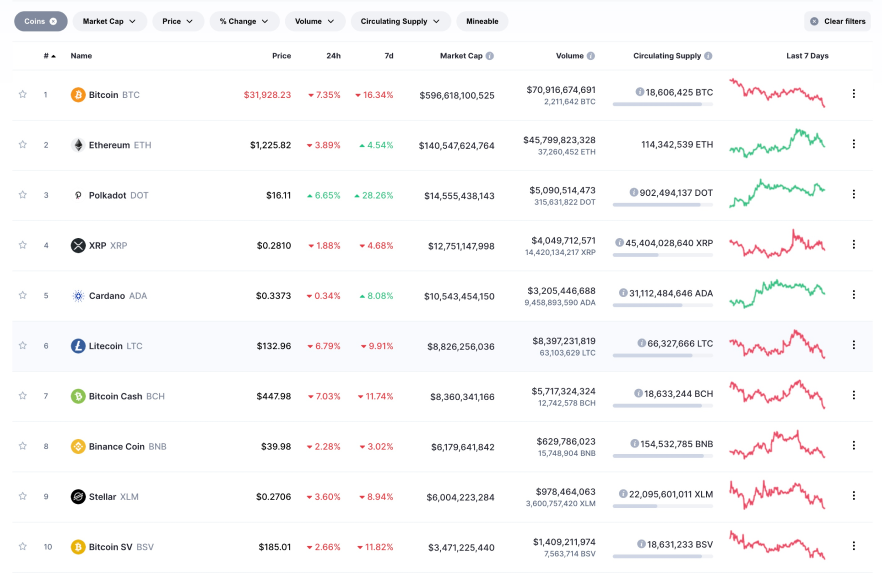

At any time, you can visit CoinMarketCap to see the coins ranked in the descending order of their market cap.

Source: CoinMarketCap | as of January 21, 2021

How is the Market Cap Calculated?

In calculating market cap, the industry uses the following formula:

Market Cap = Total Circulating Supply x Price of Each Coin

Example: If “A Coin” has 300,000 coins in circulation and each coin is worth $2, the market cap for A Coin is $600,000.

Analyzing Market Cap Size

A rule of thumb--never judge a company’s worth solely based on the price of its individual token.

Now, let’s add “B Coin” into the mix.

Example: If “B Coin” is worth $4/coin and has 50,000 coins in circulation, its market cap will be $200,000.

So, in judging the value between “A Coin” and “B Coin”, you want to focus on the market cap, rather than the individual value of A Coin and B Coin.

Here, the overall market cap and value of “A Coin” is much more than “B Coin.” This helps drive home why the market cap is a better indicator of a company’s worth than the price of its individual tokens.

Analyzing the market caps allows the industry to determine how much risk it deals with when investing in cryptocurrency. For this reason, cryptocurrencies can be classified into “large cap”, “mid-cap”, and “small-cap.”

Large-Cap Crypto

Large-cap cryptocurrencies, such as Bitcoin, Ripple, and Ethereum, have a big market cap and are considered safe investments to make. A cryptocurrency company is considered to be “large-cap” if there is more than a $10 billion market cap.

Mid-Cap Crypto

Mid-cap cryptocurrencies have a smaller market cap, but carry more risk than large-cap cryptos. A cryptocurrency company is considered to be mid-cap if they have cryptocurrencies between $1 billion and $10 billion market cap.

Small-Cap Crypto

Small-cap cryptocurrencies have the smallest market cap and present the highest risk due to the strong likelihood of failure. Cryptocurrency companies with a market cap below $1 billion are considered to be small-cap.

The cryptocurrencies you invest in are extremely susceptible to the whims of the market. In other words, you may lose everything you put in within a matter of hours, days, weeks. That high volatility can make you very rich or extremely regretful in an instant.

Distinguishing Stock Market Cap vs. Crypto Market Cap

When we are talking about stocks in the stock market, the total number of shares available helps define a company’s ownership. In that scenario, market capitalization makes sense and is an accurate metric to apply.

With cryptocurrencies, knowing the market cap alone isn’t enough when determining a company’s value. The reason being is because of the number of coins that are hoarded, locked away, and forgotten about in dormant wallets.

The term “whales”, as you may have heard are rich investors who use their financial clout to buy enormous amounts of a particular cryptocurrency for the purpose of holding them and storing them away.

At the end of the day, the market cap is just one means of analyzing a cryptocurrency’s value, and it is highly encouraged before investing in any crypto, to use due diligence and obtain both a financial advisor and legal counsel skilled in digital currency and securities law.

However, in cryptocurrencies, just by knowing the marketcap, we can’t make an accurate judgment about the company’s value. We don’t know how many of those coins are just locked up in dormant wallets and what is the true velocity of these tokens. Without all these metrics, market cap is not really the best method to judge the actual value of a cryptocurrency.