What is Balancer (BAL)?

Balancer is a DeFi protocol based on Ethereum that allows for automatic market-making (AMM). Unlike a traditional market maker/liquidity provider which buys and sells financial instruments, an AMM is a market-making agent that is controlled by algorithms that define rules for trades.

Other DeFi platforms like Uniswap and Curve also support AMM. Bringing Balancer as an AMM into Ethereum’s DeFi ecosystem, the assets in a market, along with the algorithm controlling that market, and the ability to create such a market all become decentralized.

Balancer stands out because its growing assets per market, and growing, along with custom trading fees set by the pool creator.

As between Uniswap and Balancer, please see the table below:

| Features | Uniswap | Balancer Labs |

| Supported assets | ETH & ERC20 | ETH & ERC20 |

| # supported assets per LP | 2 | 8 |

| Weighing of LP assets | 1:1 | Arbitrary |

| LP token | Yes (for bookeeping) | Yes (functional ERC-20 token) |

| Price oracle | No outside oracle, asset prices change based on trades | No outside oracle, asset prices change based on trades |

| Trading fees | 0.3% | Set by the liquidity pool creator |

| Protocol fees | No | No |

| Native token | No | No |

Uniswap vs. Balancer Labs. Source: Token Terminal

The “Flywheel Effect” and Balancer Pools

Under the pooling system, users create the “flywheel” network effect, resulting in increased liquidity, traders, fees, and profits for liquidation pools (LPs). Consequently, users can use pools in two different ways:

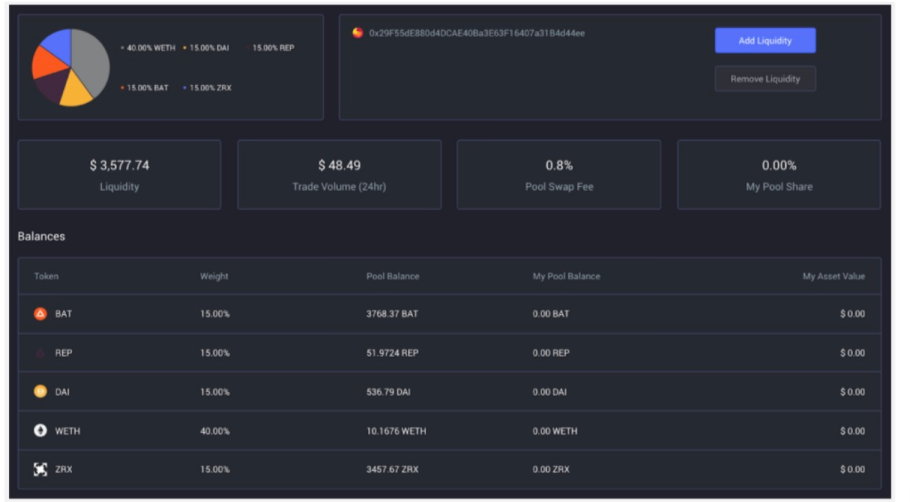

Example Balancer pool with five assets: Basic Attention Token, Augur’s REP, DAI, Wrapped Ethereum, and 0x’s ZRX

#1 - Providing Liquidity

Users are able to deposit supported assets into pools, providing liquidity to users of the pool. For those users who choose to deposit their assets into the pool, they earn a fee. However, when users provide liquidity, there’s never a guarantee they keep their assets, as there are cases where some liquidity providers may lose them.

#2 - Trading

Pools also allow for users to trade tokens, with Balancer’s smart order routing system, which helps ensure the exchange of crypto at low fees and at quick speeds.

Comparing Balancer to centralized exchanges like Coinbase and Binance, which use order books to derive prices (think of Kelly Blue Book for motor vehicles). The price of tokens in a pool is based on their deviation from their set weighting. Based on Balancer’s flexible parameters, pools serve as more than just a locale for crypto holders to exchange their assets. Balancer Labs has released pool schematics to remove the risk of LPs losing their assets.

The ‘BAL’ Token

Balancer’s native token, BAL, helps drive alignment and participation in the protocol. The total BAT supply will never exceed 100 million coins.

Layer 2 Security

The protocol implementing layer two solutions, introducing fees at the protocol level to generate revenue, and the list goes on.

“Layer 2” refers to a secondary framework or protocol that is built on top of an existing blockchain system. Example include Bitcoin Lightning Network and the Ethereum Plasma.

The $500,000 Balancer Pool Hack

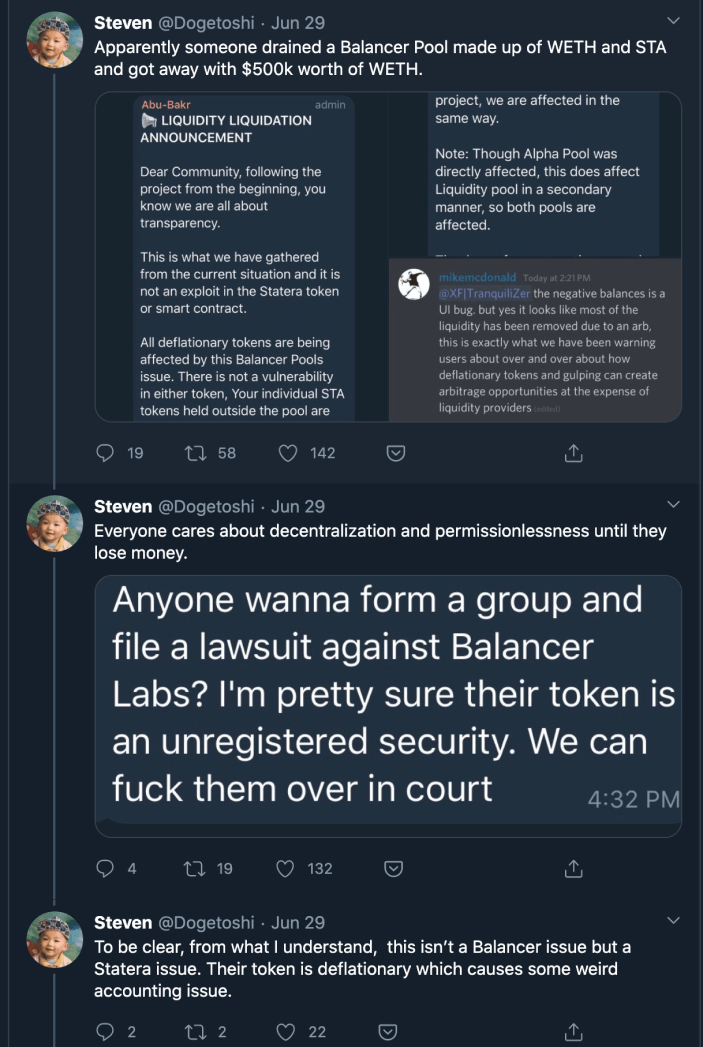

On June 28, 2020, a transaction taking more than 8 million gas, or about two-thirds of an Ethereum block, stole over $500,000 in Ether, Wrapped Bitcoin (WBTC), Chainlink (LINK) and Synthetix (SNX) tokens.

So, what exactly happened?

Remember, Balancer is decentralized, allowing for anyone to create a pool for any crypto asset, with any parameters.

Ethereum users created pools for transfer fee/deflationary tokens, which burn a portion of the coins sent in transactions. The problem is that Balancer Labs warned against this, placing deflationary tokens in pools.

Consequently, an attacker obtained a large sum of Wrapped Ethereum through dYdX, used those coins to trade WETH and STA back and forth. Those deflationary tokens also led to the pool’s downfall, causing the pool’s STA balance to reach one weiSTA, or one-billionth of a coin. This was corroborated by Balancer Labs.

Due to the infrastructure of these pools, the one weiSTA was trading at a very high price in comparison to other tokens in the pool. That cryptocurrency was then used to easily drain the other tokens in the pool. The same happened for the second pool, which contained an ETH-based asset called STONK.

Genius, right? Or just an incredibly sophisticated attack. For more information on the hack, please click here.

Following the attack, Balancer Labs ultimately blacklisted transfer fee tokens like STA, in efforts to minimize the chances of pools and maliciously designed tokens, and created a third-planned security audit.

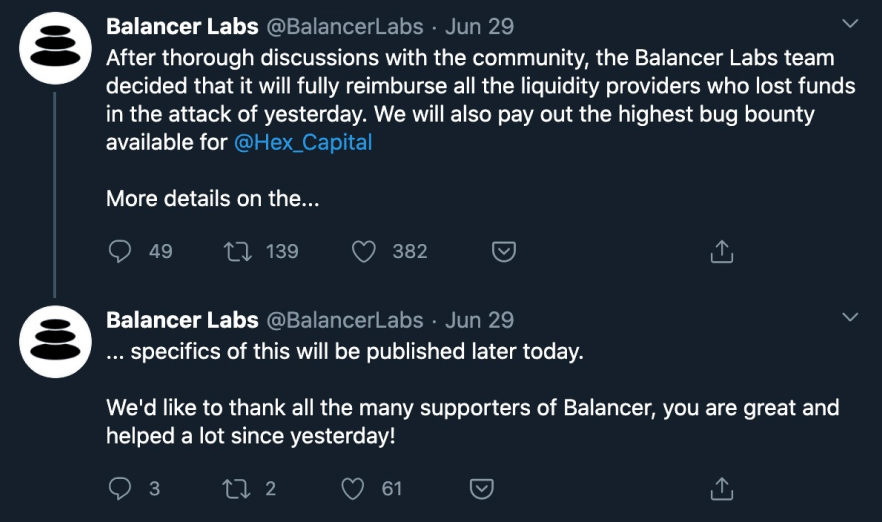

Part of that audit also included Balancer’s bug bounty program, which was designed to to “fully reimburse” all LPs affected in the crypto hack. While this wasn’t made a precedent, the company felt it should be held accountable for something it should have done better to guard against.

Balancer’s Labs’ efforts led to the launch of money-market protocol, Compound and COMP just a few weeks later.